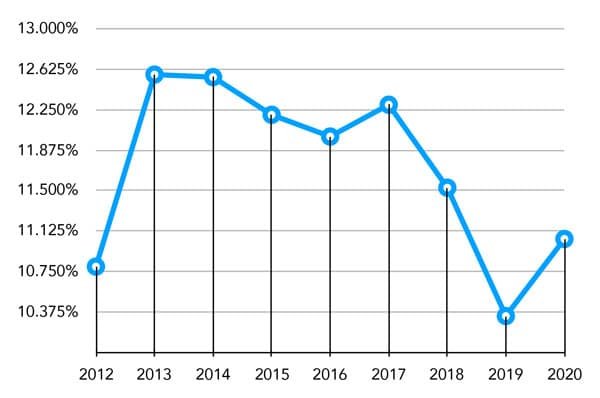

The KP 2020 mill rate is lower than all but two of the last eight years. Pierce County Assessor-Treasurer’s Office.

The KP 2020 mill rate is lower than all but two of the last eight years. Pierce County Assessor-Treasurer’s Office.

Washington state property tax is one of the most complicated in the nation, according to the Tax Foundation, an independent nonprofit research institute.

Property tax is a real estate ad valorem tax (“according to the value”) that is considered to be regressive. The Washington state average effective tax rate is 1.03 percent of assessed value, slightly below the national average of 1.08 percent.

Pierce County has the highest property taxes in the state at an average effective rate of 1.21 percent.

Taxes on real estate account for about 30 percent of all state and local tax revenues. Property taxes pay for local services like fire protection, public schools and parks, and are calculated by applying the total tax rate for a given property to the assessed value of that property. The tax rate and the assessed value can change from year to year.

Property values rose in Pierce County by 7.5 percent last year, but an increase in property value does not directly correspond with a change in property tax. The state Constitution limits the total of all non-voter approved property tax rates to 1 percent per year on a given property, plus the tax resulting from any new construction on the property.

However, there is no limit on voter-approved ballot levy taxes.

According to Pierce County Assessor-Treasurer Mike Lonergan, “Your tax in 2020 will be the 2019 value multiplied by the combined tax rates of your school district, city, fire district and so forth, added to the state and countywide property taxes that everyone pays. A lot depends on votes by the public and the Legislature.”

Lonergan said most property tax bills in Pierce County went down in 2019. This year’s increase raises them higher than 2018.

Property taxes are expected to increase by an average of 14 percent in Gig Harbor and 9 percent on the Key Peninsula in 2020.

“While our assessed values continue to rise, that’s not what drives these big increases,” Lonergan said. “Over 58 percent of the taxes I collect go to K-12 school funding, so the voted changes there have made a huge difference.”

This includes the Peninsula School District 20-year, $198,550,000 school construction bond approved in 2019 that begins this year, which adds 79 cents per $1,000 of assessed value. The education and operations levy approved this year will begin next year, replacing the existing levy at a rate of $1.50 per $1,000. The levy is for a fixed dollar amount and PSD cannot collect more money if property values increase.

The effective tax rate is expressed as a percentage of assessed value, but the amount of tax payable is usually expressed as a dollar amount of tax per $1,000 of assessed value of the property. That is called the mill rate or millage, a word that derives from the Latin word “millesimum” that means “thousandth part” (1/1000). One mill is $.001.

To convert millage rates to dollar amounts, divide the mill rate by 1,000 and multiply by the property’s taxable value. Mill rates are listed as Tax Code Area rates on individual property listings on the assessor’s website.

For example, a house assessed at $300,000 on the Key Peninsula has a 2020 mill rate of 11.051297. This is the total of all the government taxes and voter approved levies per $1,000 of taxable value. Divide the mill rate by 1,000 to get 0.011051297. Multiply that by $300,000 to get $3,315.39. Add to that any other fees and subtract any credits on the tax bill, and the result is the annual property tax, in this case an approximate effective tax rate of 1.1 percent.

The same can be done to determine the cost of an individual levy. For example, the cost of the recently approved PSD replacement levy is $1.50 per $1,000. For the hypothetical $300,000 home, that would be 1.5 divided by 1,000 and multiplied by $300,000, which equals an annual cost of $450, or $37.50 per month.

Anyone can appeal their property tax assessment. Seniors earning less than $45,708 a year and individuals with disabilities may qualify for exemption. For more information, go to www.co.pierce.wa.us.

UNDERWRITTEN BY THE FUND FOR NONPROFIT NEWS (NEWSMATCH) AT THE MIAMI FOUNDATION, THE ANGEL GUILD, ADVERTISERS, DONORS AND PEOPLE WHO SUPPORT INDEPENDENT, NONPROFIT LOCAL NEWS