The property tax rate on the Key Peninsula fell for tax year 2020, payable in 2021, but most residents will owe more because of rising property values and a surprise revaluation of certain properties.

Home prices on the KP rose 14% in 2020, reaching an average assessed value of approximately $400,000. But according to the Pierce County Assessor-Treasurer’s Office, taxes will only increase by 3.5% to 5%.

The average tax rate on the KP increased 9% in 2019 while property values rose only 7.5%. The Legislature raised the maximum local school district enrichment levy that year from $1.50 to $2.50 per $1,000 of property value, an aftershock of the state Supreme Court McCleary Decision that mandated more state funding for public schools.

Ordinarily, an increase in property value does not necessarily mean a drastic change in property tax, according to the assessor-treasurer’s office. The state Constitution limits the total of all non-voter approved property tax rates to 1% of assessed value per year on a given property, plus tax resulting from any new construction on the property.

But there is no limit on voter-approved ballot levy taxes.

The value of residential properties in Pierce County on average went up 8.8% in 2020, but mobile home owners will be hit much harder. The assessor undervalued mobile homes by an average of 25% in recent years, according to Pierce County Assessor-Treasurer Mike Lonergan, and owners will need to make up the difference.

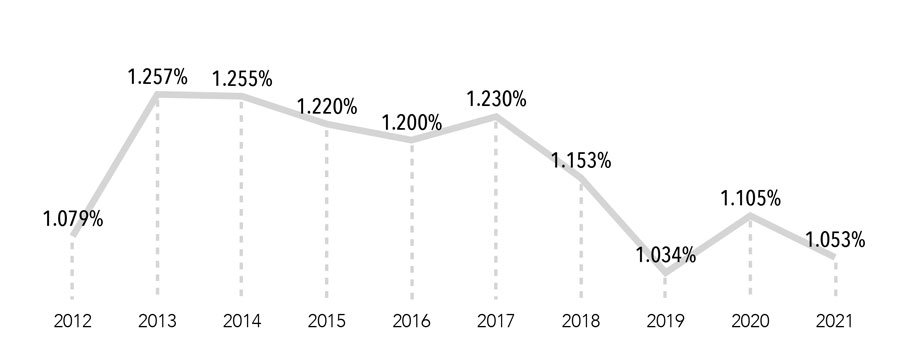

The average Pierce County property tax rate, including voter-approved levies, is now 1.19%, the highest in Washington. The state average is 0.93%; the national average is 1.07%.

Taxes on real estate account for about 30% of all state and local tax revenues. Schools make up 59.6% of the bill. County government, including the road district, adds another 21% on average, and fire districts an additional 11%. The tax also pays for parks, libraries, the Port of Tacoma, and flood control. Flat fees for conservation, noxious weed control and surface water management are also added.

Property tax is a real estate ad valorem tax (“according to the value”) considered to be regressive by many economists. It is determined by multiplying property value by the combined rate of all taxing districts where the property is located.

The amount of tax payable is usually expressed as a dollar amount of tax per $1,000 of assessed value. That is called the mill rate or millage, a word that derives from the Latin word “millesimum,” meaning “thousandth part” (1/1000). One mill is $.001 of the amount it’s applied to.

Millage rates are listed as Tax Code Area rates on individual property listings on the assessor’s website. To convert millage to dollars, divide the mill rate by 1,000 and multiply by the property’s taxable value.

For example, a house assessed at $400,000 on the Key Peninsula has a 2020 mill rate of 10.527863 for taxes payable in 2021. This is the total of all government taxes and voter approved levies per $1,000 of taxable value. Divide the mill rate by 1,000 to get 0.010527863. Multiply that by $400,000 to get $4,211.15. Add to that perhaps $140 in fees for weed control, surface water, etc., and the result is an approximate effective tax rate of 1.08%.

The same can be done to find the cost of individual charges. For example, in 2020 taxpayers started paying an additional $0.79 per $1,000 to fund the Peninsula School District 20-year $198,550,000 school construction bond approved in 2019. For the hypothetical $400,000 home, that would be 0.79 divided by 1,000 and multiplied by 400,000 for an annual cost of $316, or $26.33 per month.

Anyone can appeal their property tax assessment. Seniors earning less than $45,708 per annum and individuals with disabilities may qualify for an exemption. For more information, go to www.co.pierce.wa.us.

UNDERWRITTEN BY THE FUND FOR NONPROFIT NEWS (NEWSMATCH) AT THE MIAMI FOUNDATION, THE ANGEL GUILD, ADVERTISERS, DONORS AND PEOPLE WHO SUPPORT INDEPENDENT, NONPROFIT LOCAL NEWS